Choose the

Leader!

Tax Withholding Estimator from irs.gov

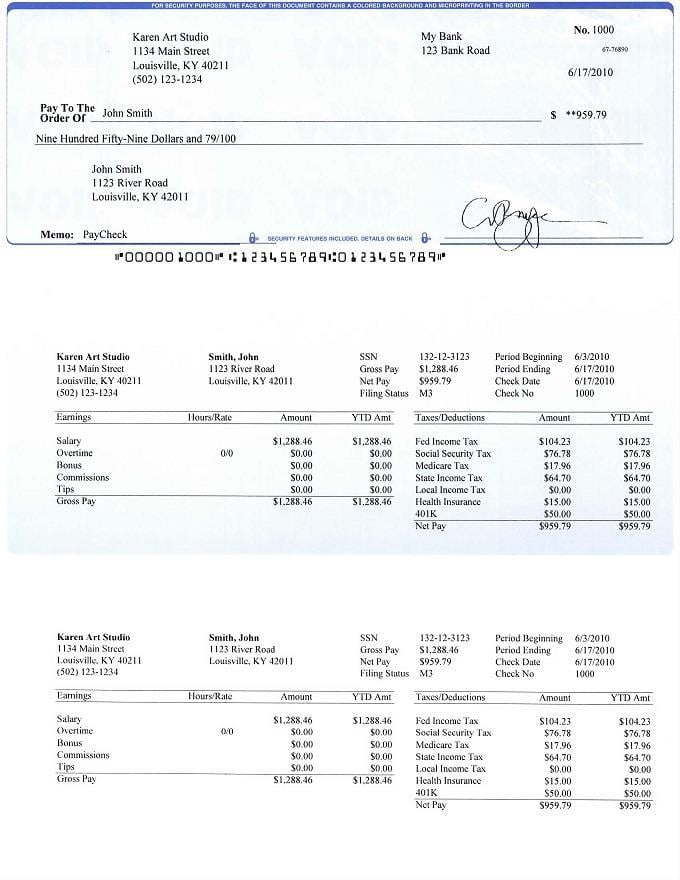

If you have a salary, an hourly job, or collect a pension, the Tax Withholding Estimator is for you. It’s a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck.

Search her for Online payroll calculators

GREAT PAYROLL

DOWNLOADABLE FORMS

* W4 FORM- click to download

* I9 FORM - click to download

you can download your checks and reports anytime you wish Request your link here!

What Our Clients Say

Truly it was a great journey, and in it I met with many, whom to know was to love; but whom never could I see again; for life has not space enough; and each must do his duty to the security and well-being of the Redoubt. Yet, for all that I have set down, we travelled much, always; but there were so many millions, and so few years.

CEO of the Company Sharon C. Lint